Qual è il miglior tracker di portafoglio cripto per voi? Con le piattaforme di criptovalute in continua espansione e l’enorme numero di asset digitali, avere gli strumenti giusti a portata di mano è essenziale. Abbiamo messo insieme un elenco completo dei migliori crypto portfolio tracker per la personalizzazione dei portafogli di criptovalute e delle app di gestione per gli investitori in criptovalute.

Queste fantastiche piattaforme affrontano alcune delle sfide più importanti nella gestione della vostra ricchezza digitale. Alcune delle funzioni più popolari includono la gestione di più criptovalute in un unico posto, la possibilità di tenere traccia di più portafogli e di navigare tra i vari piattaformadiscambio. Alcune piattaforme forniscono ancora più informazioni e permettono di rimanere aggiornati sulle tendenze del mercato. Siete curiosi di sapere quale tracker si adatta perfettamente alle vostre esigenze? Continuate a leggere perché ci addentriamo nei dettagli di ogni piattaforma, aiutandovi a decidere il miglior tracker di portafoglio di criptovalute per voi.

BeInCrypto Trading Community in Telegram: read reviews on the best crypto investment tools, discuss crypto projects, read technical analysis on coins & get answers to all your questions from PRO traders & experts!

Quali sono i migliori tracker di portafoglio per criptovalute?

Delta app

Debuting in 2017, Delta rapidly attracted one million users within its first year. Since then, its developers have consistently introduced new features and streamlined the process of monitoring one’s cryptocurrency portfolio.

Delta sets itself apart by enabling users to track not only their crypto investments but also their entire portfolio across various markets. This crypto portfolio management app supports over 300 crypto exchanges and more than 5,000 distinct crypto assets while allowing users to monitor their stock, currency, futures, ETF, mutual fund, and other market holdings.

This comprehensive tracking feature proves invaluable for many investors, as it is quite uncommon for someone to invest solely in cryptocurrencies without exposure to traditional financial instruments.

Furthermore, Delta’s high level of customization enables users to focus on specific assets and disregard the market segments they generally avoid. As such, Delta can be tailored as a crypto-only app if desired.

A key advantage of Delta lies in the extensive features offered in its free version, which includes connecting up to two exchanges and wallets. While some crypto portfolio trackers require a paid subscription for such capabilities, Delta offers more functionality without additional cost.

– Sync up to two different devices

– Link two exchange connections

– Link two wallet connections

CoinStats

CoinStats is a powerful and user-friendly portfolio tracker and manager, enabling investors to monitor their portfolio’s performance across various centralized and decentralized platforms. This is a crypto portfolio management app with a comprehensive dashboard that streamlines asset management by eliminating the need to visit multiple websites.

By linking accounts to CoinStats, customers can set up instant portfolio notifications and analyze the performance of specific assets or wallets. Some supported exchanges even allow direct trading of digital currencies from the CoinStats landing page.

With over 1 million active monthly users, the platform primarily functions as a portfolio tracker. To thrive in this space, CoinStats supports integration with over 400 wallets and exchanges, including Coinbase Pro, Binance, CoinSpot, Trust Wallet, and cold hardware wallets like Ledger Nano. However, direct integration with CoinStats is possible for around 70 apps, while manual portfolios can be added for other platforms. The platform is particularly compatible with the Ethereum ecosystem, ERC-20 tokens, and decentralized apps (DApps).

CoinStats’ dashboard allows users to view their entire portfolio performance instantly and analyze specific holdings’ trends. For instance, users can compare the earnings of their staked digital currencies to those held in a crypto savings account.

Uniquely, CoinStats offers users the opportunity to participate in DeFi liquidity mining. To simplify the process, especially for beginners, CoinStats automatically navigates through supported platforms, including M-Stable Polygon, M-Stable, Yearn Finance, and Lido.

CoinStats’ earning product presents a convenient option for users seeking a straightforward way to generate passive income.

– 10 connected portfolios

– 1,000 transactions per month

– NFT management

– Option to buy crypto through third-party exchanges

CoinTracking

CoinTracking is not only one of the top crypto portfolio trackers but also a dependable crypto tax software that allows users to analyze their trades and generate real-time tax reports.

Supporting over 24,000 coins and assets, it provides 25+ customizable crypto reports, 12 tax methods, and tax and capital gains reports for over 100 countries, along with round-the-clock professional support. The platform primarily targets advanced and professional traders, as well as businesses.

CoinTracking offers four distinct packages, including a Free Account that covers up to 200 transactions at no cost. The platform accepts payment in bitcoin and over 50 altcoins.

The software is compatible with more than 75 exchanges and 20 wallets, delivering 25 customizable crypto reports and interactive charts for trades and coins.

Available on both Android and iOS, CoinTracking provides professional assistance and features four plans: Free, Pro, Expert, and Unlimited, accommodating nine payment methods.

CoinTracking ensures security through comprehensive data protection, API encryption, and two-factor authentication. It also integrates seamlessly with TurboTax for a hassle-free tax filing experience.

– Transaction tracking 200 (If the limit is exceeded, you cannot enter any new transactions. However, you can sum up transactions with the same timestamp (or delete transactions) to create new space.)

– Manual Exchange Import (CSV) – up to 5 MB per CSV file

– Two manual blockchain transaction imports for any public key

– Tax & capital gains reporting limited to 100 entries

– Transactions and raptors exports (CSV, XLS, PDF, HTML)

– Two portfolio backup

– Limited accounts

Kubera

Kubera is well-suited for individuals with various asset classes to manage. While numerous software applications enable connections to bank and investment accounts, Kubera automatically updates your home’s value and connects to major cryptocurrency wallets for real-time asset valuation.

Moreover, Kubera is an excellent choice for those who wish to securely pass on essential documents to others. It is designed for individuals with more complex financial situations who may require assistance in managing their assets. Kubera simplifies information sharing with your financial management team or your power of attorney holder.

Kubera connects to major crypto wallets and exchanges, allowing you to incorporate DeFi assets into your net worth. This feature is especially useful for those new to buying cryptocurrency, as it helps keep track of tokens.

Unlike many net worth trackers and personal finance apps, Kubera provides secure storage for crucial information like account passwords and important documents. The automatic transfer of information when you’re inactive adds another layer of convenience.

Kubera connects with over 20,000 financial institutions worldwide, displaying the value of connected accounts in your preferred currency for a more accurate understanding of your available resources.

Kubera doesn’t offer a free plan. However, you can test the personal plan for only $1 for 14 days. After that, it will cost $150 per year.

Coin Tracker

Cointracker is redefining one-dimensional apps by becoming a top portfolio and tax manager application.

The tool features an automatic import from exchanges and presents a unified dashboard that displays comprehensive information about a user’s crypto assets. The dashboard showcases real-time token prices, historical data, deposits, withdrawals, market caps, and concisely illustrates the user’s portfolio performance.

Cointracker.io is known for its unmatched features, such as historical data, market caps, price tracking, and more. It offers accounting, fintech, blockchain, digital currencies, and other financial services to users worldwide. Currently, the platform supports over 500,000 users and tracks over 2,500 crypto coins, including bitcoin, ethereum, ripple, litecoin, binance coin, and many others.

Additionally, Cointracker excels at reading CSV import files, allowing users to import and export CSV files to other devices. A free account is available for managing up to 200 trades, but upgrading is required to access all features. Key Cointracker features include wallet tracking, multiple cost basis methods, auto wallet sync, tax form generations, fee tracking, trade reports and investment performance.

– Up to 10,000 transactions

– Auto sync with unlimited exchanges and wallets

– Cost basis methods

– Transaction history and capital gains CVS downloads

– DeFi functionality

– Margin trading

Coinigy

Coinigy is a top global digital asset exchange service in the financial market, enabling traders to execute trades across multiple exchanges and customize trading strategies using over 130 technical indicators. Coinigy allows transaction history imports and generates crypto tax reports for investors and traders, which can be shared with tax professionals.

Coinigy supports more than 5,000 digital assets and forex trading pairs, providing access to various global financial markets.

Featuring a simple, well-organized interface, traders can access multiple exchanges on a single platform. The variety of accounts and order types allows users to select the best combination for their needs, with unlimited trading and additional features. New users can subscribe to copy trading signals for Bitmex and Binance.

As a promising startup, Coinigy offers 24/7 live chat support and a knowledge base for beginners entering the crypto world. Coinigy stands out as one of the best cryptocurrency trading platforms, providing complete access to multiple exchanges, including Binance, Bitfinex, Bitstamp, Coinbase and more. Its ability to connect with over 45 crypto exchanges enables users to access real-time spot trading, margin trading, copy trading, price data, arbitrage trading opportunities, and aggregation tools.

The platform also features advanced anti-theft device technology, enabling users to monitor their crypto wallets and conduct portfolio tracking from a single location. Coinigy is highly transparent, with no additional fees charged to users, although a small subscription fee may apply after the trial period.

– Unlimited, no-added-fee trading

– HD charting w/75+ technical indicators

– 24/7 automatic portfolio monitoring

– 24/7/365 security & stability

– Mobile app access

– Email support

Cova

Cova is a convenient tool for tracking assets. Users can synchronize their bank accounts, investments, and apps to access balances and asset holdings in one location.

The register allows real-time tracking of over 150,000 global stocks and 8,000 crypto tickers, wallets, and exchanges. Cova’s support for more than 11,000 financial institutions and major global crypto exchanges makes account linking easy.

Users can collaborate with a custom peer group, including financial planners, attorneys, and advisors, by granting them access to their portfolio for assistance in estate planning and other financial matters. Spouses can also be included in the collaboration, allowing users to share their net worth for loan applications.

Cova allows users to designate beneficiaries and activate the Lifechecker setting. Users receive emails prompting them to click a link to verify their activity on Cova and confirm they are alive. If users fail to verify their status after a specified number of days, their portfolios are sent to their beneficiaries.

An additional safeguard can be set up by enabling a trusted helper to inform the recipient of the portfolio if they are unreachable. A trusted helper should act on the user’s behalf and in the recipient’s best interest.

In addition to traditional and digital asset tracking, Cova allows users to store documents securely in a vault, making it easier to manage scattered wills, notes, videos, and other media.

Manual assets tracking; no real-time updates.

Manual liabilities tracking; credit cards, loans, etc.

Assign a beneficiary to your portfolio

500MB storage space for vital documents

Manage portfolio beneficiaries; create a deadman’s switch

No cryptocurrency exchange/wallet tracking

The Crypto App

The Crypto App aims to rival well-established crypto portfolios tracking apps like Coinstats, Coinmarketcap, and Coingecko. Over the past two years, the company has made significant progress, amassing nearly half a million active users and more than 1.35 million downloads.

The Crypto App offers a crypto wallet supporting various cryptos. Users can receive, send, exchange, buy, sell, and withdraw multiple cryptocurrencies. The platform provides several BTC purchasing methods, including fiat and crypto-to-crypto options. Users can also directly buy BTC using MasterCard/Visa with 1%-2% fees.

Users can view and track their portfolios without opening the app through app widgets. They can also set up a range of widgets, such as price charts, portfolio returns, news, and market stats. Widgets can be customized to enhance user experience.

Public addresses can be connected to track wallet balances from the blockchain, including ERC20 and BEP20 tokens. Manual input is also available to track portfolios.

The Crypto App’s “price alerts” feature ensures users don’t miss significant price movements by sending reliable push notifications, even when the app is closed. Users can set price or percentage increase/decrease notifications and customize alerts with features such as repeat alerts, alert tones, notes, and announcements.

Users can also access the latest cryptocurrency news from over 100+ sources in seven languages, directly on the app.

– Two market metrics

– Token metrics

– Five wallet connections

– Three crypto exchange connections

– 100 real-time alerts

– Five currency converter pairs

AssetDash

AssetDash presents itself as an operating system but primarily functions as a crypto portfolio management app. Developed by privacy-focused traders, investors, and cybersecurity professionals, AssetDash allows users to access the platform anonymously by default.

The software can be accessed via AssetDash’s web-based platform or its mobile app, allowing users to start using it on their preferred devices without sharing personal information. However, users will still need to input their financial account details to link and import information into the portfolio tracker software.

AssetDash primarily caters to multi-asset investors, NFT and cryptocurrency traders, and those who would typically need multiple tracking apps to monitor their positions. It also enables users to track stocks, mutual funds, and bank balances. AssetDash is particularly beneficial for traders and investors with crypto assets stored across various networks and blockchains, as well as NFT investments.

The platform supports hundreds of apps, covering different financial markets. Users can link their crypto exchange addresses, track NFTs and decentralized financial (DeFi) assets, and connect stock brokerage and bank accounts.

It tracks NEAR protocol, Ethereum (ETH), and Solana (SOL) NFTs, which typically require multiple portfolio trackers.

Decentralization, often considered a significant advantage for cryptocurrencies, can complicate digital asset tracking and potentially deter new retail crypto investors and traders. AssetDash addresses this issue by allowing real-time monitoring of all crypto investments. Users can track crypto assets on over 100 top custodial digital asset platforms, including popular options like Binance, Robinhood, and Coinbase, ensuring access to real-time data.

A standout feature of AssetDash is its free-to-use nature, which contributes to the remarkably high rating for customer pricing in this review. The absence of payment information requirements further enhances user anonymity while utilizing the software.

Altrady

As a trading terminal, Altrady enables users to access various markets from a single platform. By partnering with exchanges like Binance, Kraken, Coinbase, and Poloniex, Altrady streamlines the investing process. This integration grants access to countless crypto investment opportunities by allowing trading across any partnered market.

Users can simply choose an exchange, explore coins and tokens, track market movements, and monitor their investment progress directly through Altrady.

Traders often want to examine potential trading platforms and practice placing orders before opening an account. Altrady not only allows platform exploration but also offers a 24-hour demo without requiring email verification. Users can investigate supported coins and tokens, create sample alerts, learn about various order types, and more before deciding if Altrady suits their needs.

Altrady provides constantly updating charts, making it easier for users to monitor crypto movements and determine the right time to enter the market.

For those who need to keep an eye on their crypto account and market movements without constantly checking their phone or computer, Altrady’s signal bot allows setting a wide array of customizable alerts for price changes, targets, market movements, and more. Users can receive notifications via email, push notifications, or direct desktop alerts.

Altrady’s platform enables easy customization of charting tools and platforms to display only the most relevant cryptocurrencies or analysis methods. Widgets offer an additional layer of personalization, allowing users to drag and drop tools, charts, or screeners to tailor their trading strategy.

The platform only offers a 14-day free trial. After the trial, it costs €25 per month.

Koinly

Koinly is an excellent choice for a tax and portfolio app due to its wide range of features and functionalities. With automated crypto tax reporting, Koinly simplifies the process of managing your crypto taxes. It seamlessly integrates with over 400 crypto exchanges and wallets, allowing real-time tracking of transactions and monitoring of gains and losses. That’s why we believe it is one of the top crypto portfolio management apps.

Koinly generates tax reports for over 100 countries, including the U.S., U.K., Canada, and Australia. It supports various accounting methods, such as FIFO, LIFO, Highest Cost, Average Cost Basis, and more, catering to users’ specific needs. Comprehensive reporting of taxable events, including trades, transfers, airdrops, forks, DeFi income, and mining, ensures thorough tax compliance.

For added convenience, Koinly integrates with popular tax software like TurboTax and TaxAct. The platform’s ability to import data from CSV and Excel files further enhances its versatility. Additionally, Koinly offers cryptocurrency portfolio tracking and analytics, helping users keep an eye on their investments.

Support for tax formats like Form 8949 and the capability to populate figures for Schedule D make Koinly a comprehensive solution for crypto tax reporting. It also distinguishes income from various sources, such as staking, mining, and lending, enabling accurate tax calculations.

Koinly is ideal for international traders and users with moderate trading volumes. Its free version provides a tax overview, but report generation requires payment. The software is compatible with all popular DeFi protocols and automatically imports NFT trades for EVM-based blockchains like ETH, Polygon, BSC, and Chronos.

While Solana and other less popular chains await automatic support, users can manually add their NFT trades. In comparison to its competitors, Koinly excels in supporting other countries but falls short in tax-loss harvesting capabilities.

– 10,000 transactions (you can buy additional transactions in the app)

– Unlimited wallet and exchange accounts

– Portfolio tracking

– Capital gains preview

– DeFi, margin trades and futures

– FIFO, LIFO, Average Cost & more

– Wallet-based cost tracking (Spec ID)

– Avalanche trades (group orders for the same trade to minimize number of transactions)

– Smart transfer matching (automate transaction matching to pay less in taxes)

– Exchange & transaction fee tracking

– CSV file import

– Migrate from Cointracking, Cointracker

– Email support

Perché vi serve un’app crypto portfolio tracker?

Un’app crypto portfolio tracker è uno strumento indispensabile per chi investe nel mondo in continua evoluzione degli asset digitali. Le app sicure per il monitoraggio dei portafogli consentono agli investitori di tenere traccia di tutte le loro partecipazioni in criptovalute in un’unica piattaforma.

Ci sono diversi motivi per cui è necessario averne una nel proprio arsenale. Vediamo i vantaggi dell’utilizzo dei tracker di portafoglio per la gestione delle criptovalute:

- Panorama d’investimento diversificato. Con l’espansione del mercato delle criptovalute, gli investitori stanno diversificando i loro portafogli tra varie criptovalute. Un’app tracker consente di gestire e monitorare tutte le partecipazioni in un unico luogo, risparmiando tempo e fatica.

- Dati e analisi in tempo reale. I mercati delle criptovalute sono noti per la loro volatilità. Un’app tracker fornisce aggiornamenti in tempo reale sui vostri investimenti. Vi fornisce informazioni istantanee sul rendimento del vostro portafoglio e vi aiuta a prendere decisioni informate.

- Organizzazione semplificata. Tenere traccia di più portafogli e piattaformadiscambio può essere un compito scoraggiante. Un tracker di portafoglio consolida tutti i vostri investimenti, offrendo una visione chiara e organizzata dei vostri asset digitali.

- Avvisi e notifiche. Un’app di monitoraggio del portafoglio di criptovalute consente di ricevere avvisi e notifiche personalizzati. In questo modo, non perderete mai un’opportunità o un aggiornamento critico del mercato.

- Ottemperanza fiscale e normativa. Con l’inasprirsi delle normative fiscali sugli asset digitali, un’app tracker può aiutarvi a mantenere registri accurati. Questi sono necessari ai fini della dichiarazione dei redditi e per conformarsi alle autorità competenti.

Dopo tutto, ogni anno vengono creati sempre più asset digitali. Come ha spiegato l’ex CEO di Google, Eric Schmidt, in un intervento al Computer History Museum nel 2014:

“Il Bitcoin è un risultato crittografico notevole… La capacità di creare qualcosa che non è duplicabile nel mondo digitale ha un valore enorme… Molte persone costruiranno aziende sulla base di questo”.

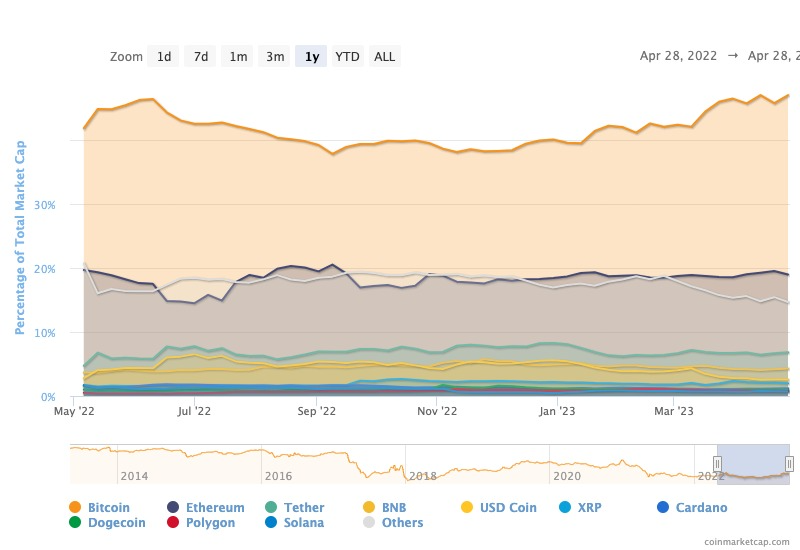

Inoltre, basta guardare il grafico della posizione dominante del bitcoin per rendersi conto della natura dinamica del mercato delle criptovalute.

Come scegliere il miglior crypto portfolio tracker?

Scegliere il migliore tra questi tracker di portafoglio per criptovalute è un passo essenziale sia per gli investitori esperti che per quelli alle prime armi che vogliono gestire in modo efficace i propri asset digitali. Come già detto, i vantaggi dell’utilizzo dei tracker di portafoglio per criptovalute sono molteplici. Tuttavia, non è possibile sceglierne uno che sia il migliore per tutti gli investitori.

Con una varietà di opzioni disponibili, ognuna delle quali offre caratteristiche uniche, è fondamentale trovare uno strumento che si allinei alle proprie esigenze e preferenze. Quando scegliete un tracker, considerate fattori come la facilità d’uso, la compatibilità con più piattaformadiscambi e portafogli, il supporto per diverse criptovalute, i dati in tempo reale e gli avvisi personalizzabili.

Inoltre, date priorità alla privacy, alla sicurezza e alla personalizzazione della piattaforma per migliorare la vostra esperienza complessiva dell’importanza di un accurato monitoraggio del portafoglio. Valutando attentamente i principali concorrenti di cui abbiamo parlato, potrete trovare un tracker di portafoglio per criptovalute che semplifichi il vostro processo di investimento e vi aiuti a prendere decisioni informate nel mondo in continua evoluzione degli asset digitali.

Sponsored Sponsored| Integrazioni supportate | Criptovalute supportate | Riportare le tasse | |

| App Delta | 300+ | 7,000+ | No |

| CoinStats | 70+ | 8,000+ | No |

| CoinTracking | 100+ | 24,000+ | Sì |

| Kubera | 20+ | N/D | No |

| Inseguitore di monete | 300+ | 2,500+ | Sì |

| Coinigy | 45+ | 5,000+ | No |

| Cova | 26+ | 8,000+ | No |

| L’App Crypto | 100+ | 6,000+ | No |

| AssetDash | 100+ | 7,000+ | No |

| Altrady | 17+ | 7,000+ | No |

| Koinly | 400+ | 20,000+ | Sì |

La gestione degli asset semplificata

Come detto in precedenza, la gestione degli asset è difficile, ed è per questo che molte persone fanno carriera. Comunque sia, i tracker di portafoglio per criptovalute semplificano questo processo.

Sono finiti i giorni in cui bisognava tenere traccia di ogni piattaformadiscambio, portafoglio, criptovaluta, prezzi di entrata e uscita e altre informazioni su registri separati.

Con queste utili app potete gestire le vostre attività finanziarie da uno o pochi posti. In questo modo, eviterete un mondo di grattacapi, di rimescolamenti di carta e, soprattutto, di controlli finanziari a causa di registri non conservati.

Frequently asked questions

It is challenging to pinpoint a single “best” crypto portfolio tracker for managing a crypto portfolio, as individual preferences and needs vary. However, you can consider Delta, Coinigy, Altrady, AssetDash, Cova, and The Crypto App as top contenders. Evaluate their features, such as ease of use, compatibility with multiple exchanges and wallets, real-time data, and customizable alerts, to find the ideal solution for your unique crypto portfolio management requirements.

To effectively manage your crypto portfolio, consider using a crypto portfolio tracker such as Coinigy, Altrady, AssetDash, Cova, or The Crypto App. These tools help you monitor your investments across multiple exchanges and wallets, track real-time market data, set customizable alerts, and access advanced analysis features. Choose a platform that suits your preferences and requirements to simplify your crypto portfolio management and make informed decisions based on comprehensive insights.

To keep track of your crypto portfolio, use a reputable portfolio tracker like Delta, Coinigy, or The Crypto App. These tools allow you to monitor your investments across various wallets and exchanges, stay updated with real-time market data, set personalized alerts, and benefit from advanced analytics features. By selecting a platform that aligns with your needs, you’ll be able to easily track your crypto portfolio and make well-informed decisions based on consolidated and up-to-date information.

Yes, there are crypto portfolio managers available, such as Delta, Kubera, Coin Tracker, Cova, and The Crypto App. These crypto portfolio management apps help you manage your crypto investments by consolidating data from various wallets and exchanges, providing real-time market insights, and offering advanced analytics features. By choosing a suitable crypto portfolio manager, you can optimize your investment strategy, track your assets, and make informed decisions to improve your overall portfolio performance.

Yes, Excel can pull crypto prices using the WEBSERVICE and FILTERXML functions or by connecting to an API. By using these methods, you can import real-time cryptocurrency price data directly into your Excel spreadsheet. One popular option is to connect Excel to a service like CoinMarketCap or CryptoCompare, which provides APIs to access price data. Keep in mind that some APIs may require you to sign up for an API key. There might also be usage limits depending on the specific service.

While several portfolio trackers are available for crypto investors, it’s hard to pinpoint a single one that can be labeled as the ‘best.’ However, Delta, CoinTracking, Cova, Coin Tracker, and Koinly are top crypto portfolio trackers that you can consider.

Examine features such as customizable alerts, compatibility with different wallets and exchanges, and real-time crypto portfolio updates to find one that fits your needs.

While it’s difficult to state that one crypto and NFT portfolio tracker is the best, several trackers such as Delta, Koinly, AssetDash, and Kubera trackers stand out when it tracking your crypto and NFT assets. The best crypto and NFT tracker will suit all your needs, as different trackers have different features.

The Delta app is one of the most accurate crypto price trackers you can get. The Delta tracker allows users to track their crypto portfolio and their entire portfolio across different markets. In addition, you can use Delta to compare and contrast the performance of several digital currencies against each other.

It’s impossible to say which technical indicator is the most popular because there is no reliable data on what indicators traders are using globally. Having said that, the Relative Strength Index (RSI) is one of the most popular crypto indicators. The RSI crypto indicator helps to measure the strength of a specific digital currency’s price movement, making it a valuable took in a trader’s toolkit.

There are a handful of crypto indices created by crypto trading platforms to enable traders and investors to bet on the overall performance of the crypto markets. It’s difficult to pinpoint which is the best index to track crypto but examples include CryptoGT’s GTi12 Index and AvaTrade’s Crypto10 Index.

Yes, crypto trading indicators are real. However, they are tools that use mathematical calculations derived from an asset’s volume and/or price. Trading indicators measure volatility, identify trends, and offer signals for trade.

Crypto traders can use various technical analyses. Deciding on the best one will be dependent on the indicators used. Some technical analyses best suited for crypto include Bollinger Bands, moving average convergence divergence (MACD), or the relative strength index. Therefore, it’s impossible to pinpoint a single technical indicator and labelling it as “the best.”